LYLE BUNN

Digital Media Strategy Architect, BUNN

Lyle@LyleBunn.com

Lyle Bunn is an independent analyst, advisor and educator providing digital place-based signage expertise to end users in the planning, design, sourcing and optimization of their initiatives. He has published more than 300 articles, whitepapers and “how to” guides and helped to train over 10,000 end user and supply professionals. See www.LyleBunn.com.

Some banking sector case studies of digital signage use offer useful insights to maximizing the return on digital signage investment.

The Royal Bank of Canada (RBC) was named Global Retail Bank of the Year in 2014 and 2015 by Retail Banker International and offers its services in 37 countries. RBC was one of the first banks to use dynamic place-based digital media in branches and their way of applying it offers important insights to all customer-facing organizations as provided by Alan Depencier, VP Marketing of RBC to delegates of the Interactive Customer Experience (ICX) Summit in Dallas.

Depencier summarized that “Digital is as much a cultural change as it is a communications paradigm” in describing the changes that forward-thinking consumer-facing organizations are making in applying branch/store/restaurant digital place-based media.

He added, “One of the key challenges of digital on-location media, as part of an integrated client experience, is in its change management requirement in interior design, technology and merchandising. The elements of investment validation, budgeting, layout of the customer environment, design of the engagement experience including adapting the customer interaction and adding new skills all contribute to maximizing the value.

“What makes a bank most different from other retailers, and we are a retailer”, said Depencier, “is that we do not have any physical products. This makes our marketing in this highly competitive sector of particular challenge”.

“A key to our success” he described “has been in holding up the brand value proposition against the physical location. When you do this, improvements are readily indicated and these are the foundation for improved customer experience.”

“Lead with strategy and client experience intentions, and then select technologies to enable these in a way that delivers value “in the now” while enabling economies of operations and future proofing,” Depencier advised.

“Change management is the journey of learning how to do it well. Marketers learned how to do mass communications and today are targeting messages better than ever before, but all customer-focused communications is on the path toward intuitive engagement in which customer awareness and business goals are merged to meet the needs and wants of all stakeholders. Dynamic, technology-based engagement is one of the most effective ways of achieving this” said Depencier.

Visitors to RBC branches can see many examples of tactical engagement. For example, patrons could place the coins from their pocket or purse on a digital table, which when detected illustrates how saving the amount of the coins could result in savings growth over time.

Other gamification that inform, inspires and engages customers include presenting true/false or multiple choice questions as a way to provide information about product features and benefits.

Digital place-based media should enable staff success and move the brand forward in “conversational commerce”. Depencier noted, “RBC advisors are inclined to learn what customers are learning and asking about through the on-location messaging”.

Bank of America has also been a long-standing user of in-branch digital signage. In 2014, the marketing division launched a concerted effort to further exploit the benefits of their system that had been installed in over 2000 branches.

The bank provided an in-depth briefing of the six major creative and ad agencies it used for video production, marketing campaigns, outdoor advertising, online promotion and static poster programs to rally agency efforts toward improved in-branch content. Not only did the Chief Marketing Officer want to better harmonize communications along the customer’s path to purchase/service, but also the “transmedia” opportunity was clear. Content created for use in other communications was to be re-purposed where suitable for in-branch displays that spoke to patrons as they were in the branch.

This process was very successful as the Bank Of America was recognized with an APEX Award during Digital Signage Expo in March 2015. Change management to better take advantage of the digital signage investment was focused on better engaging marketing communications suppliers so that their contributions could also benefit in-branch communications.

While creative production for the online experience made significant contributions, it was the agency that produced static posters that had the most to offer. Chicago-based based TPN (which had nominated Bank of America for the APEX Award), leveraged its capabilities to craft simple, core messaging by adding animations so the combination of the medium and the messaging maximized marketing spending.

In summary, change management in support of the brand objectives is the key to the success of the in branch, store and restaurant digital signage program success. When the current brand objectives are considered against the current on-location experience for patrons, the ways in which in which the medium can serve the enterprise become quickly evident.

Digital signage is one of the brands most influential communications tools for customers that express and want alignment with the brand, and the products and services that are promoted on digital signage help both the brand and the customer benefit from the brand-product-customer interaction.

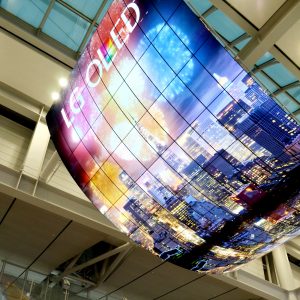

On this July 4th weekend as we celebrate America’s independence, we can’t help but think about the incredible fireworks shows that will be sparkling skies across the USA. And we want to do it justice with our own celebrations too—ever watch the Macy’s fireworks on an LG video wall? Add a great sound system with rocking subwoofers and it’s one spectacular experience! Now just wait until you see it on our new OLED products. More great things are coming soon.

On this July 4th weekend as we celebrate America’s independence, we can’t help but think about the incredible fireworks shows that will be sparkling skies across the USA. And we want to do it justice with our own celebrations too—ever watch the Macy’s fireworks on an LG video wall? Add a great sound system with rocking subwoofers and it’s one spectacular experience! Now just wait until you see it on our new OLED products. More great things are coming soon.